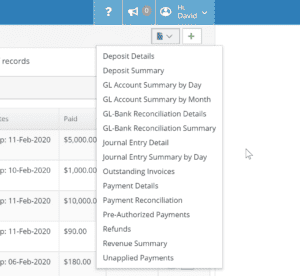

Alinity has new and updated reports available to help administrators successfully reconcile their bank transactions with those recorded in Alinity.

The preferred/expected reconciliation process is as follows:

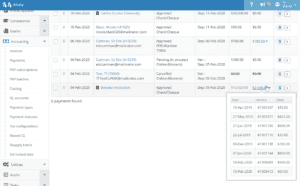

- Clean up bad data – run the Payment Reconciliation report, selecting for Errors and warning, with the appropriate cut off date. If you’ve got errors in your data for the time period you’re reconciling for, you should clean those up before proceeding with your reconciliation.

- Reconcile against your Deposit Summary report for the same time period.

- If there is a discrepancy between your bank statement and the total in the Deposit Summary report, use the Deposit Details report to locate and correct the error.

- Complete your GL-Bank reconciliation (if required).

This main workflow is now supported by new reports that can be used to reconcile your General Ledger (GL) with your bank transactions, locate problems and errors on individual payments, or to locate and reconcile refunds. There are also two new reports, the Unapplied Payments report and the Pre-Authorized Payments (PAP) report, which can be used for data maintenance and locating information (or errors).

This main workflow is now supported by new reports that can be used to reconcile your General Ledger (GL) with your bank transactions, locate problems and errors on individual payments, or to locate and reconcile refunds. There are also two new reports, the Unapplied Payments report and the Pre-Authorized Payments (PAP) report, which can be used for data maintenance and locating information (or errors).

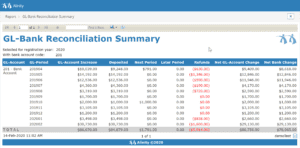

GL – Bank Reconciliation Summary

This report is used to reconcile your General Ledger with your bank account, and will expose transactions (both payments and refunds) where the month in which the Deposit Date occurs is not the same as the month the GL Posting Date appears in. For example, you may receive a cheque payment for an application fee on the last day of the month. You then record the payment, but don’t actually deposit the cheque into your bank account until the following day. As a result, the GL transactions for the payment will be dated for one month, but deposit dates will be for the next month. As a result, these transactions may confuse clients trying to reconcile their bank statement as the GL Posting and Deposit dates can occasionally be different.

This report is used to reconcile your General Ledger with your bank account, and will expose transactions (both payments and refunds) where the month in which the Deposit Date occurs is not the same as the month the GL Posting Date appears in. For example, you may receive a cheque payment for an application fee on the last day of the month. You then record the payment, but don’t actually deposit the cheque into your bank account until the following day. As a result, the GL transactions for the payment will be dated for one month, but deposit dates will be for the next month. As a result, these transactions may confuse clients trying to reconcile their bank statement as the GL Posting and Deposit dates can occasionally be different.

This report helps alleviate this confusion by showing users how much of an increase their GL account has recorded during the period being reported on, and how much of that amount has actually been deposited within that period. It also shows the total value of transactions where the GL posting date is within the time period being reported on, but where the Deposit date is in the next period. Clients can use this report for simpler reconciliation, just by ensuring that the total of both the Deposited and the Next Period columns matches the GL-Account Increase column. In rare cases, you may see a value in the Later Period column; that column should be included in the total to be compared against your GL-Account Increase column as well.

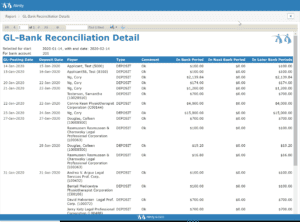

GL – Bank Reconciliation Details

Similar to the GL – Bank Reconciliation Summary report, the GL – Bank Reconciliation Details report shows details about each individual payment within the selected reporting period. These details include the GL Posting Date, the Deposit Date, the type of payment, and any comments that might have been left on the payment record. Whether the payment appears in the current bank period or later bank periods also appears. While the summary report described earlier is excellent for fast and simple reconciliation, this details report is best suited to locating issues and problems within your reconciliation and provides the necessary information for locating and fixing errors found during basic reconciliation.

Similar to the GL – Bank Reconciliation Summary report, the GL – Bank Reconciliation Details report shows details about each individual payment within the selected reporting period. These details include the GL Posting Date, the Deposit Date, the type of payment, and any comments that might have been left on the payment record. Whether the payment appears in the current bank period or later bank periods also appears. While the summary report described earlier is excellent for fast and simple reconciliation, this details report is best suited to locating issues and problems within your reconciliation and provides the necessary information for locating and fixing errors found during basic reconciliation.

Payment Details

If throughout your reconciliation process you discover an error and need to examine a specific payment, the new Payment Details Report provides all the relevant information administrative users may require about an individual payment record. You may also occasionally need to report on an individual payment to a 3rd party. However you use it, the report shows all the invoices the payment has been applied to, so if you’re investigating a single large payment from an organization that covers multiple registrants’ renewal fees, that information will be displayed. All invoices that a payment has been applied to are grouped together by the date the payment was applied, and any invoices that were cancelled will be appear with their text struck out.

If throughout your reconciliation process you discover an error and need to examine a specific payment, the new Payment Details Report provides all the relevant information administrative users may require about an individual payment record. You may also occasionally need to report on an individual payment to a 3rd party. However you use it, the report shows all the invoices the payment has been applied to, so if you’re investigating a single large payment from an organization that covers multiple registrants’ renewal fees, that information will be displayed. All invoices that a payment has been applied to are grouped together by the date the payment was applied, and any invoices that were cancelled will be appear with their text struck out.

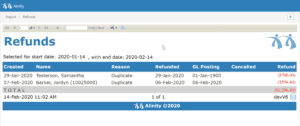

Refunds

The new Refund report is another excellent new tool for aiding the reconciliation process, since it can be used to locate refunds or to further investigate them if needed to complete your reconciliation. The Refund report shows all your refunds in a given period which you can select for. The date refunds were created, who they were provided to, the reason for the refund, the refund and GL Posting dates, and the date the original payment was cancelled are all included in the report along with the amount of the refund. Subtotals are provided if there were multiple refunds on a day, and the refund will be struck-through if it was cancelled for some reason.

The new Refund report is another excellent new tool for aiding the reconciliation process, since it can be used to locate refunds or to further investigate them if needed to complete your reconciliation. The Refund report shows all your refunds in a given period which you can select for. The date refunds were created, who they were provided to, the reason for the refund, the refund and GL Posting dates, and the date the original payment was cancelled are all included in the report along with the amount of the refund. Subtotals are provided if there were multiple refunds on a day, and the refund will be struck-through if it was cancelled for some reason.

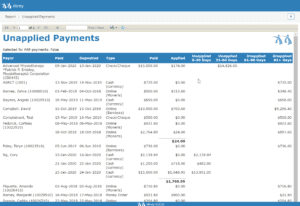

Unapplied Payments

The Unapplied Payments report is a new report unrelated to the reconciliation process but which can be used for improving your data quality and locating errors. This report shows all unapplied payments, sorted by payor, and includes paid dates, amount deposited, the type of payment, how much of the payment (if any) has been applied, and how long the payment has remained unapplied. This last bit of information should be of particular interest to regulators, as we highly recommend regularly investigating and updating out-of-date unapplied payments. In fact,

The Unapplied Payments report is a new report unrelated to the reconciliation process but which can be used for improving your data quality and locating errors. This report shows all unapplied payments, sorted by payor, and includes paid dates, amount deposited, the type of payment, how much of the payment (if any) has been applied, and how long the payment has remained unapplied. This last bit of information should be of particular interest to regulators, as we highly recommend regularly investigating and updating out-of-date unapplied payments. In fact,

This report is used to clear out your unapplied payment liability account at the end of any given period. Don’t be concerned if your Unapplied Payments report is empty because that’s actually best; it means all payments you’ve received have been both recognized as revenue and applied to an invoice or refund.

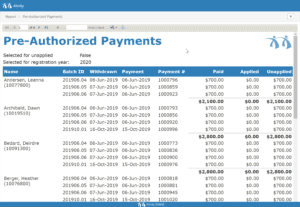

Pre-Authorized Payment (PAP)

The fifth new report is the Pre-Authorized Payments, or PAP report. This is a reconciliation report intended to show end-users the status of their PAP clients’ balances including how much have they paid in, how much of the balance has been applied (if any), and what remains as unapplied. Cancelled payment entries appear as stricken-through text. This report provides excellent visibility on PAP payments for administrators, also including the batch I.D., withdraw date, payment date, and payment number, and is excellent for clearing PAP payments that aren’t going to be applied when renewal comes, such as when someone moves to to a new jurisdiction halfway through the year, or chooses to change to a different register with a different fee schedule.

The fifth new report is the Pre-Authorized Payments, or PAP report. This is a reconciliation report intended to show end-users the status of their PAP clients’ balances including how much have they paid in, how much of the balance has been applied (if any), and what remains as unapplied. Cancelled payment entries appear as stricken-through text. This report provides excellent visibility on PAP payments for administrators, also including the batch I.D., withdraw date, payment date, and payment number, and is excellent for clearing PAP payments that aren’t going to be applied when renewal comes, such as when someone moves to to a new jurisdiction halfway through the year, or chooses to change to a different register with a different fee schedule.

Online Payment Detail

For clients who primarily reconcile from their online payment processor, the new Online Payment Detail report provides information about all online payments during a specific period of time. This report is used for reconciling online payments exclusively, and includes the payments’ verification times, transaction IDs, and whether the payment was deposited in the previous or current deposit period (among other information).

Payment Type Summary

Similar to the Online Payment Detail report, the Payment Type Summary report summarizes all the payments across all payment types for all payments in a given period. This is another excellent report for assisting in reconciling your GL with Alinity and your online payment processor, with summarized information about every payment type to make reconciling by payment types, such as cheques, cash, virtual terminal payments and other payment types, simple and easy. Information about whether payments were included in the current or previous period is also included.

Improved Reports

In addition to the new and significantly revised reports above, some other already existing reports were revamped for improved readability.

- GL Account summary by Month

- GL Account summary by Day

- Journal Entry Detail

- Journal Entry Summary by Day

- Journal Entry Summary by Month

- Deposit Detail

- Deposit Summary